W4 allowance calculator

Complete Edit or Print Tax Forms Instantly. Ad Are You Withholding Too Much in Taxes Each Paycheck.

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

250 and subtract the refund adjust amount from that.

. Our withholding calculator doesnt ask you to provide personal. To change your tax withholding amount. Filling out the form has become streamlined.

Please visit our State of Emergency Tax Relief page for additional information. For employees withholding is the amount of federal income tax withheld from your paycheck. Afraid You Might Owe Taxes Later.

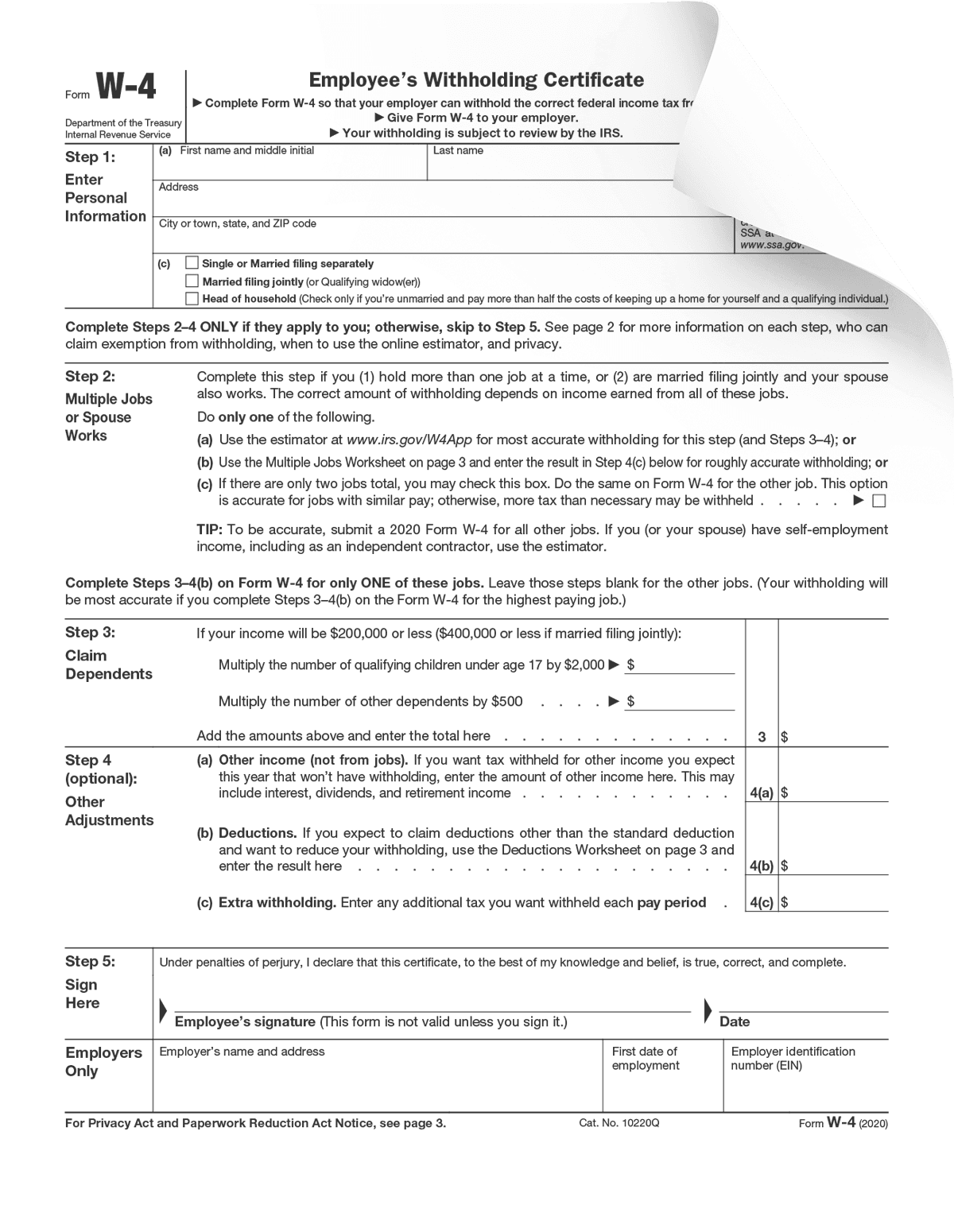

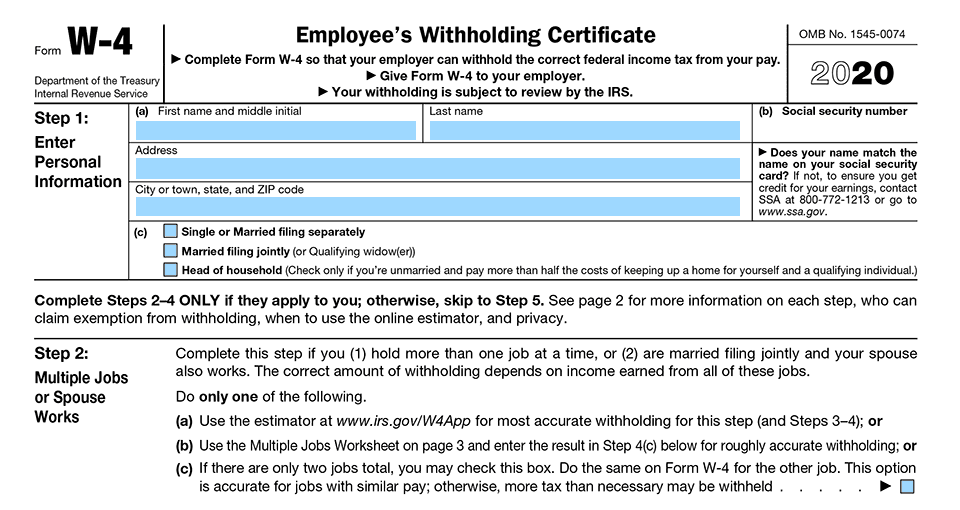

Employees should complete an Employees Withholding Allowance Certificate Form NJ-W4 and give it to their employer to declare withholding information for New Jersey. Complete Edit or Print Tax Forms Instantly. If changes to withholding should be made the Withholding Calculator gives employees the information they need to fill out a new Form W-4 Employees Withholding.

Your tax liability is the amount of money that you owe to the government in federal. Up to 10 cash back Maximize your refund with TaxActs Refund Booster. Need to adjust both your federal and state withholding allowances go to the Internal Revenue Service IRS website and get Form W-4 Employees Withholding Allowance Certificate.

It is important that your tax withholding match your tax liability. It was best to move away from. IRS tax forms.

250 minus 200 50. Businesses impacted by recent California fires may qualify for extensions tax relief and more. The number of allowances would depend on your situation.

The amount of income tax your employer withholds from your regular pay. The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund. Read on to learn.

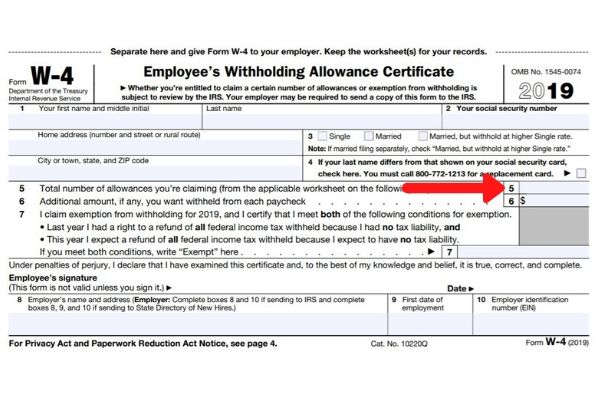

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. However this allowances section of the W-4 has been removed. This W4 calculator tool comes in handy when youre claiming head of household 2000 or more in child or dependent care expenses or eligibility for the Child Tax Credit.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Oregons withholding calculator will help you determine the number of allowances you should report on Form OR-W-4. Figure out which withholdings work best.

For instance it is common for working. That result is the tax withholding amount. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Use our W-4 calculator. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. If you are not sure how many allowances to claim you can use the IRSs online allowance calculator.

Ask your employer if they use an automated. Please refer to 2020 Form W-4 FAQs if you have questions regarding the changes in the new 2020 Form W-4 compared to the 2019 Form W-4. Our free W4 calculator allows you to enter your tax information and adjust your paycheck.

Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime. You should claim 0 allowances on your W-4 2022 tax form if someone is claiming you as a dependent on their own tax form. If changes to withholding should be made the Withholding Calculator gives your clients the information they need to fill out a new Form W-4 Employees Withholding Allowance.

Ad Access IRS Tax Forms. Then look at your last paychecks tax withholding amount eg. This calculator will ask you questions about your personal situation.

W4 Calculator Cfs Tax Software Inc Software For Tax Professionals

Irs Witholding Calculator

2020 W 4 Updated

Irs Improves Online Tax Withholding Calculator

W 4 Form Basics Changes How To Fill One Out

W 4 Form What It Is How To Fill It Out Nerdwallet

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

What To Do When The Irs Is After You Personal Finance Organization Irs Personal Finance Lessons

Understanding Your W 4 Mission Money

Form W 4 Form Pros

How To Fill Out Your W4 Tax Form W4 Tax Form Tax Forms Income Tax Preparation

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

Irs Releases Second Draft Of 2020 Form W 4 Tax Withholding Estimator Check Out The Latest Updates To 2020 Form W 4 The Irs I Irs Federal Income Tax Draught

What Is A W 4 Form Form Pros

Payroll Calculator In Microsoft Excel Microsoft Excel Templates Themes Top Techniques To Cal Learning And Development Communication Skills Excel Templates

How To Fill Out The New W 4 Form Arrow Advisors

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero